We’re Here for You

Contact Us for a Free Case Evaluation

Our team is ready to listen day or night – 7 days a week, so contact us now to see how we can help you on the road to recovery.

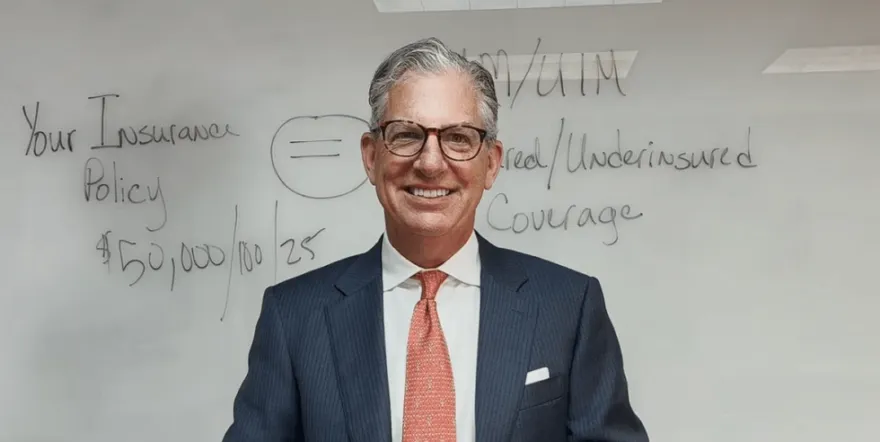

Virginia law requires drivers to have minimum car insurance coverage, but most people don’t know exactly what they are paying for or when that protection comes into play. The insurance companies are counting on you not reading the fine print. In this video, Brother Rutter, Managing Partner at Rutter Mills explains the hidden coverage you may not know you have and how it can turn your policy limit into a six-figure payout for your medical bills, lost wages, and pain & suffering after an accident.

Watch this important 8-minute video on Vimeo.

The car accident attorneys at Rutter Mills know how to maximize your claim because they have been studying insurance policies for decades. After an accident, the first place we look for coverage to get you money for expenses incurred from someone else’s negligence is the insurance policy written for the defendant’s vehicle. Even if the other driver borrowed someone’s car, is an uninsured driver with no insurance of their own, we “follow the car.”

Been in an accident with an uninsured driver?

Offers for Policy Limits

After a serious car accident, insurance companies are often quick to make injured drivers an offer to settle their claim. They may even say it’s the maximum amount of the policy. Sounds great right? Wrong. It turns out, you’re not always in “good hands” with the insurance company.

They’re hoping you won’t understand just how much compensation you may be entitled to. Before you accept an offer, make sure you speak with an experienced car accident attorney. For over 60 years, Rutter Mills has been fighting to get injury victims the money they need and deserve after a serious accident. If you have been injured, our team is available day or night to answer your questions about where to find insurance coverage to get you the benefits to help you recover.

In Virginia, your car insurance coverage for uninsured or underinsured drivers is equal to the limits of your liability coverage. It’s a requirement meant to protect you if a driver injures you and/or damages your vehicle but does not have enough insurance to cover your expenses. It’s also there to protect your family members in the same situation. If you are seriously injured and have medical bills in excess of the policy limits, you may be able to use not only your own insurance but also the policies held by any family members living with you.

People often ask us at Rutter Mills, “Will using my Uninsured/Underinsured Motorist Coverage hurt my or my family’s insurance rates?”

No need to worry, a Virginia statute protects drivers from insurance company backlash after using this portion of your policy.

In this quick message, Brother Rutter breaks down this statue, highlighting how it is illegal for insurance companies to penalize a policyholder for using their uninsured & under-insured motorist coverage.

Speaking with someone who understands how to make your insurance work for you after an accident can mean the difference between getting on the road to recovery or getting stuck with a mountain of debt. So contact the car accident teams at Rutter Mills today and make sure you get the protection you have been paying for. Don’t let the insurance companies deny you the benefits you deserve. Show them you mean business. Call or text us any time at (757) 777-7777.

Contact Us for a Free Case Evaluation

Our team is ready to listen day or night – 7 days a week, so contact us now to see how we can help you on the road to recovery.